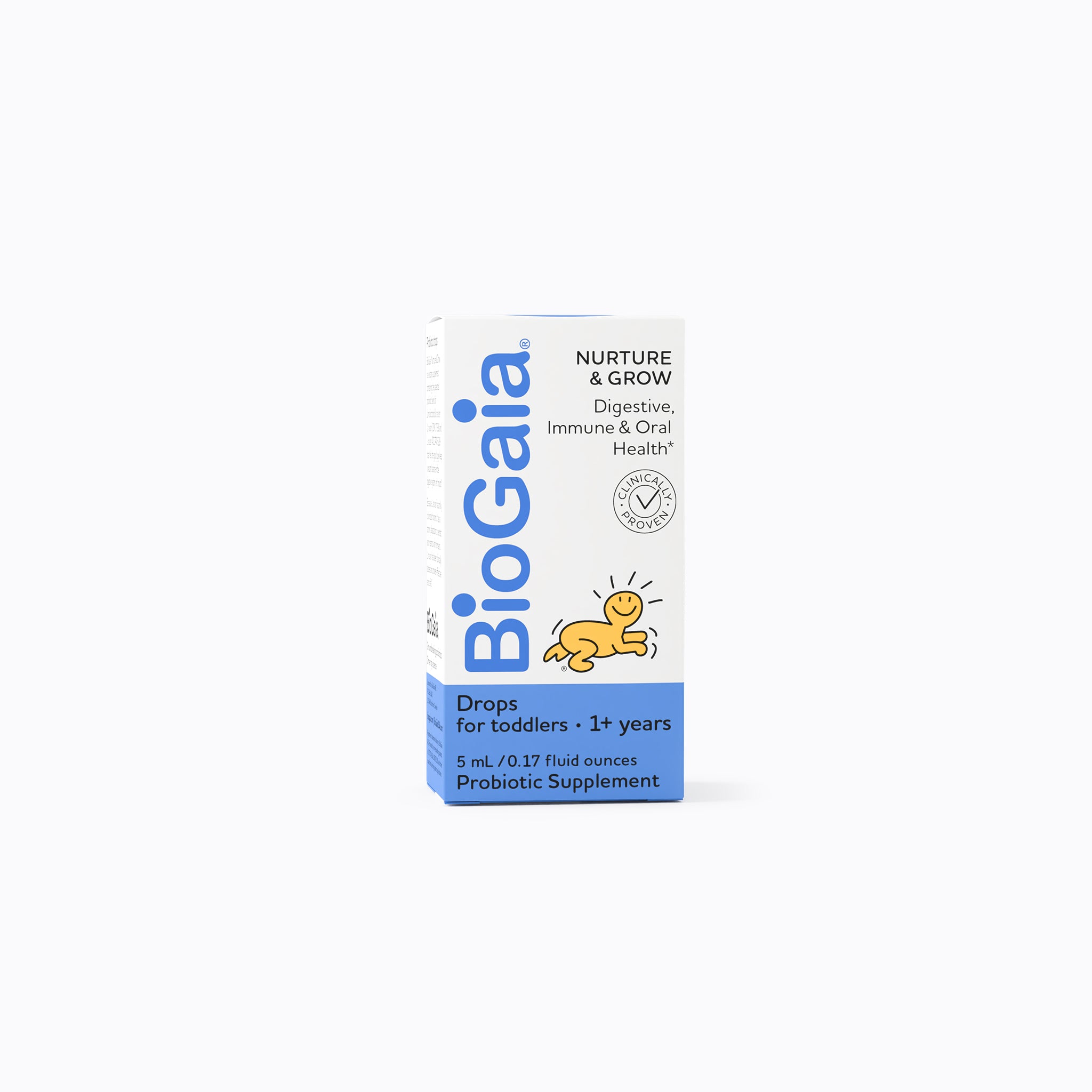

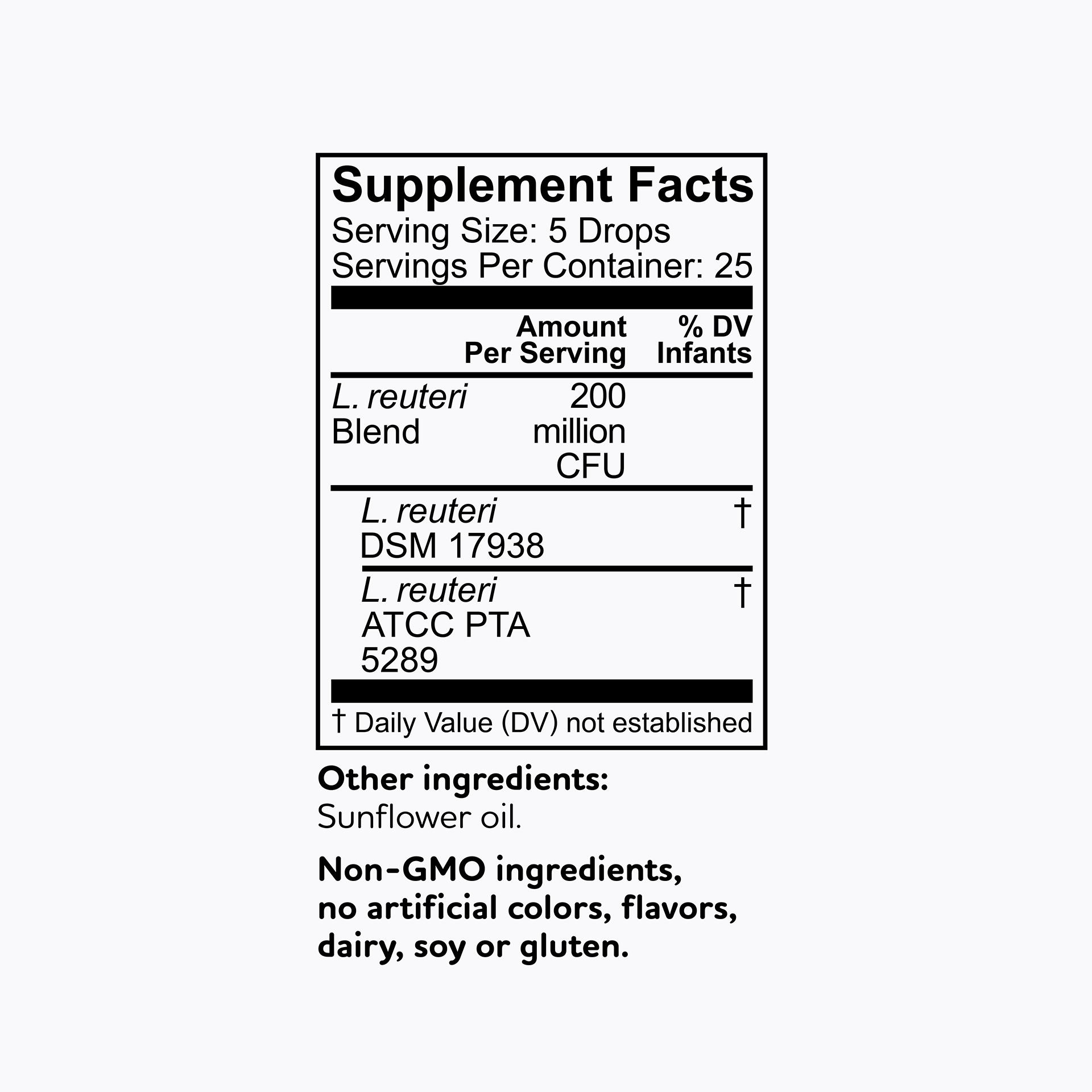

Probiotics throughout life.

We love science. It’s part of our DNA. Literally.

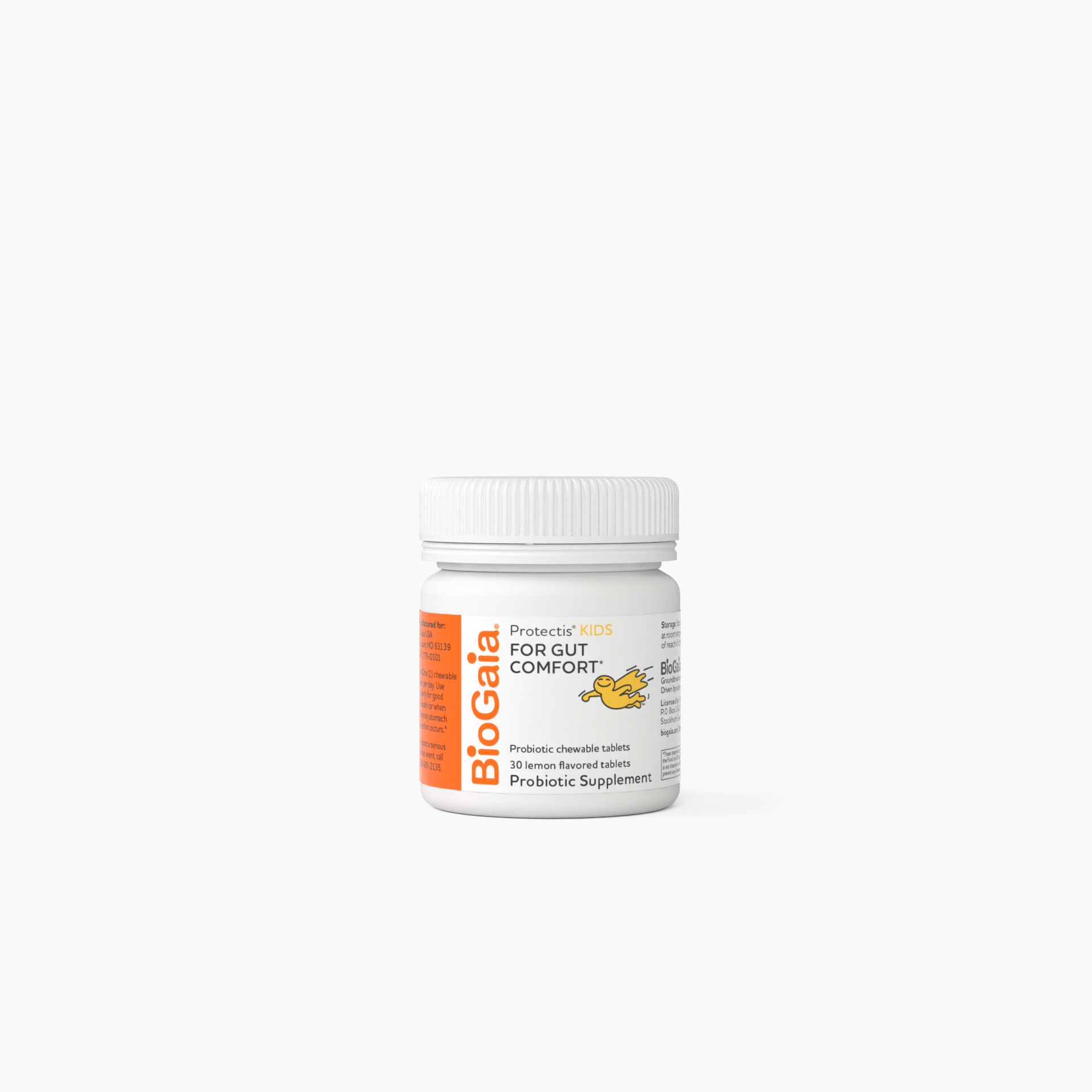

Discover our probiotics for adults and probiotics for children.

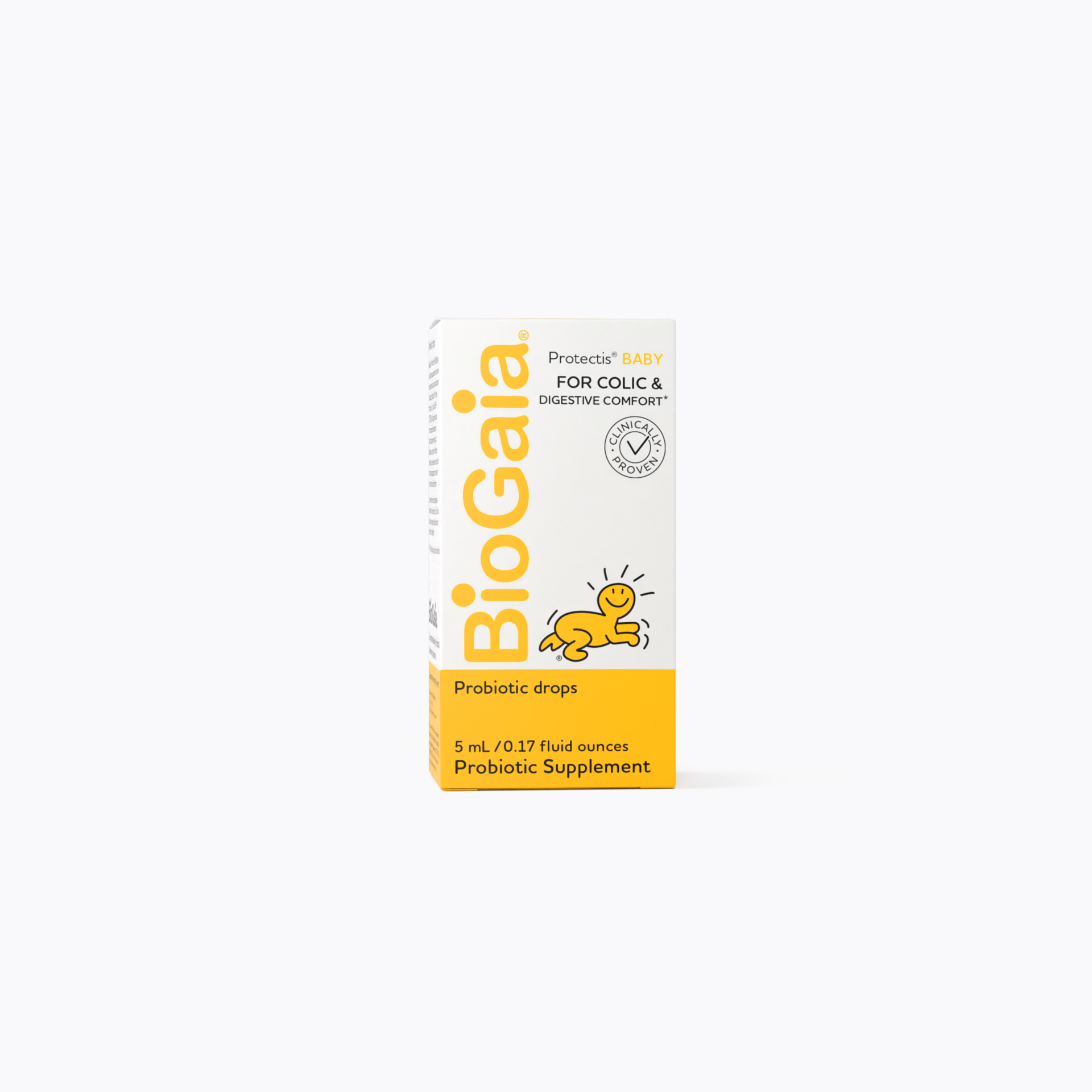

BioGaia is a world leader in probiotic research and development. Our clinically proven probiotics have been supporting the health and well-being of people everywhere, throughout every stage of life, since 1990.

Explore our Learning Lab

Good health starts with good education. Learn all you need to know about probiotics, good bacteria, and much more.

How to choose probiotics

There are several key things you need to look for when choosing a probiotic. Here, we outline the essentials.

Discover more on our blog

How nourishing your forgotten organ can help to beat the bloat

What are the 7 most important organs of your body?Most people would have no trouble listing the major players in the game: the brain, the...

Probiotics: Your new travel companion

Traveling the world can be enriching, but it can also take a toll on our digestive system. Changes in diet, water, and sleeping patterns can...

Building your baby's first home: How a healthy gut during pregnancy benefits you and your child

The bond between mother and baby begins even before birth The journey to motherhood is as extraordinary as it is transformative. The countless changes a...

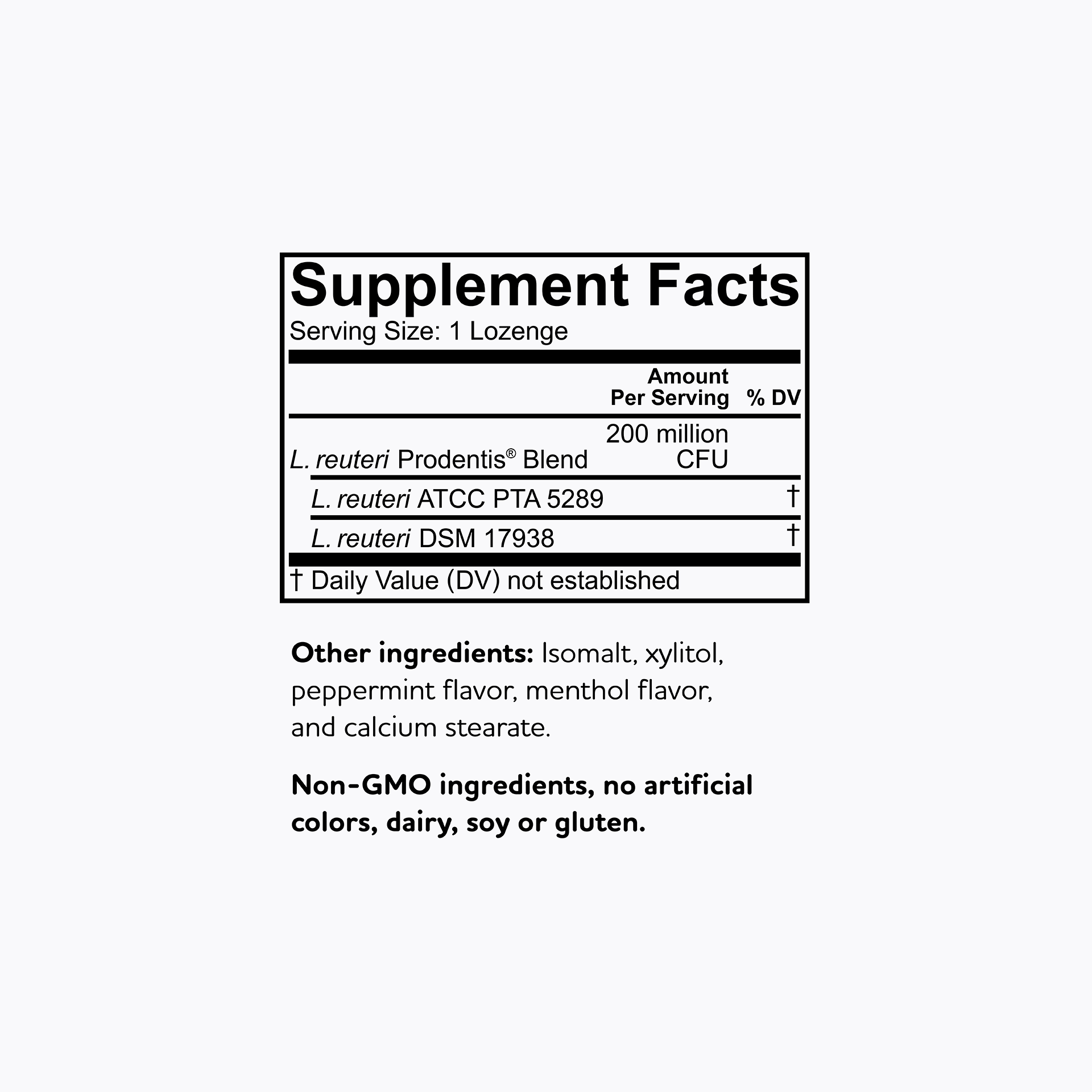

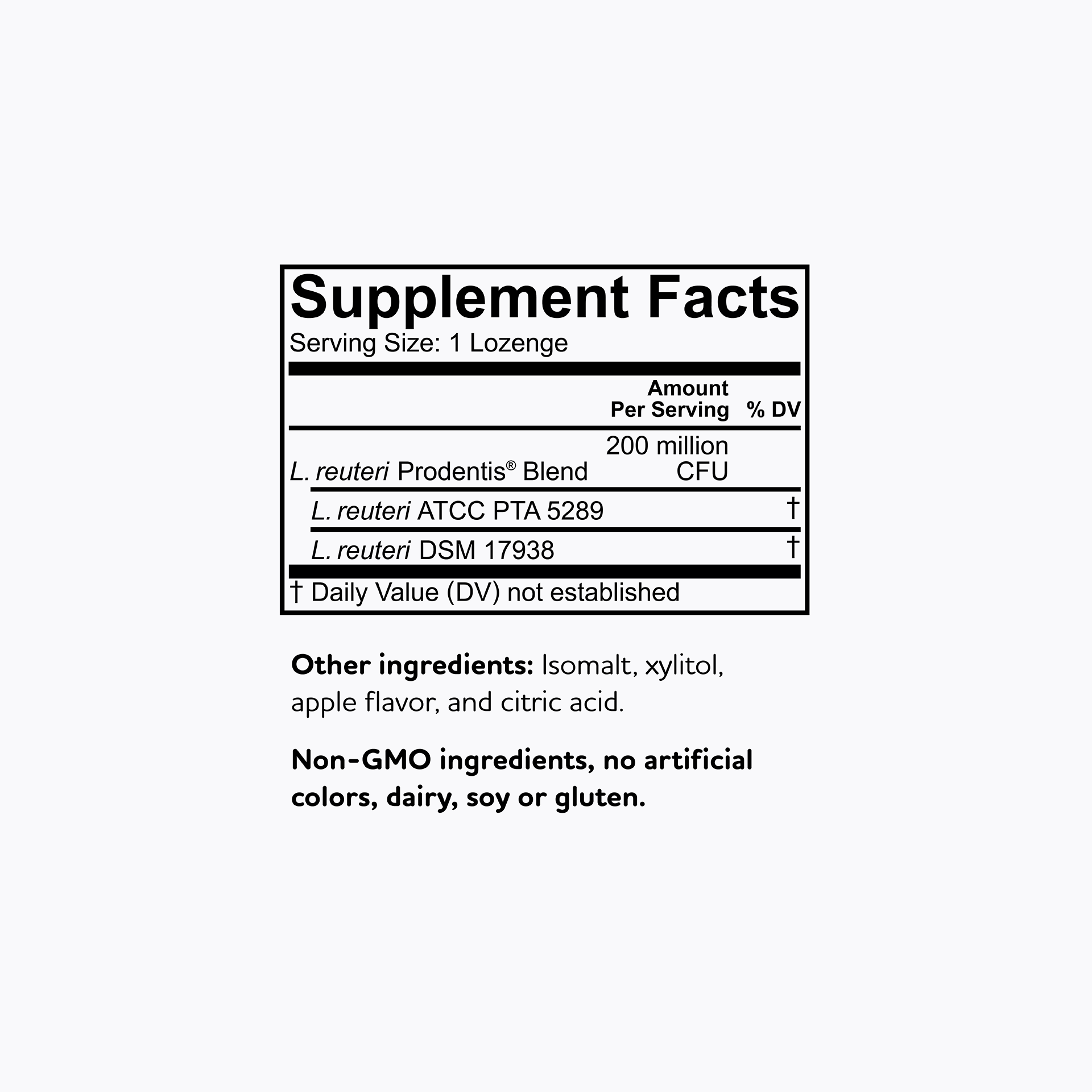

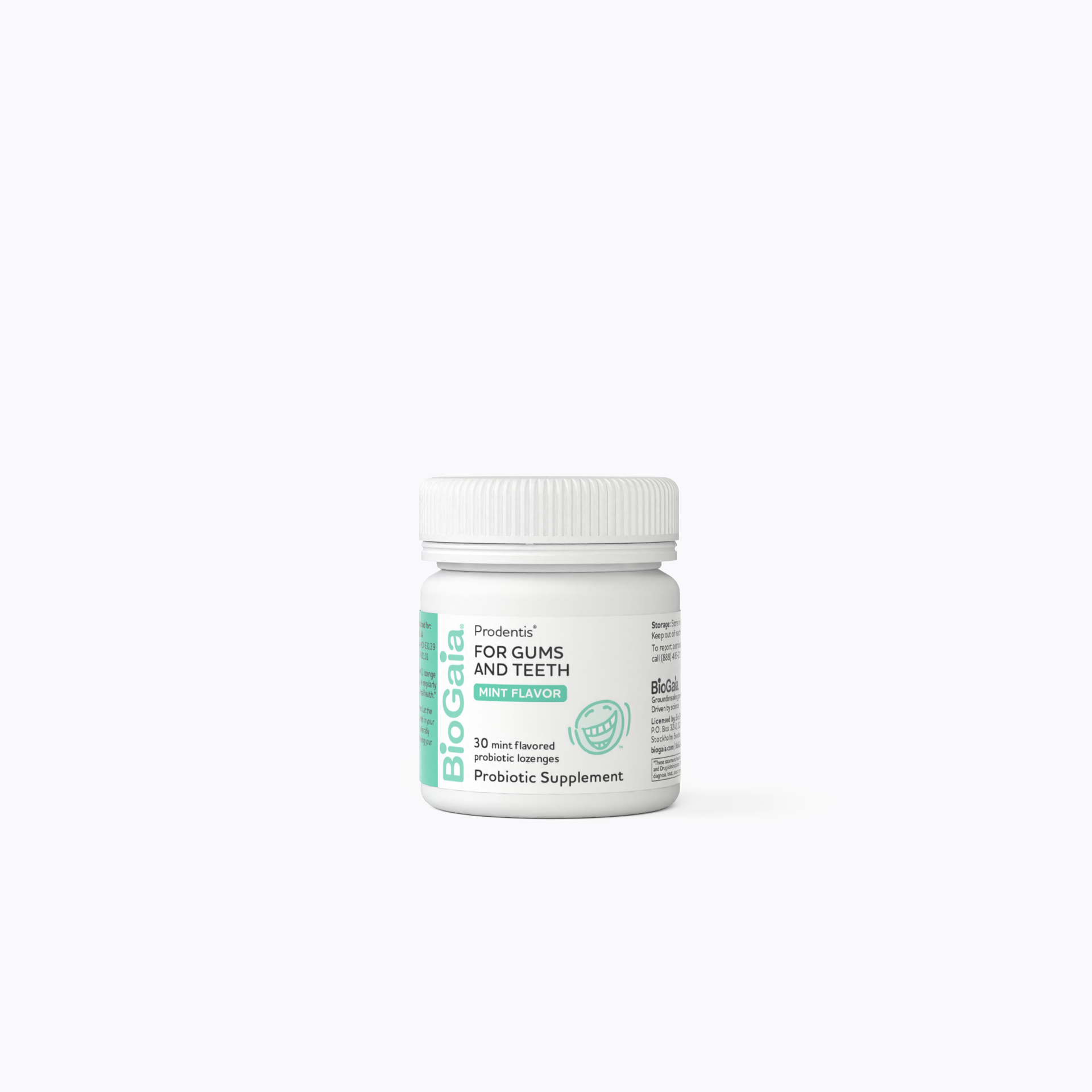

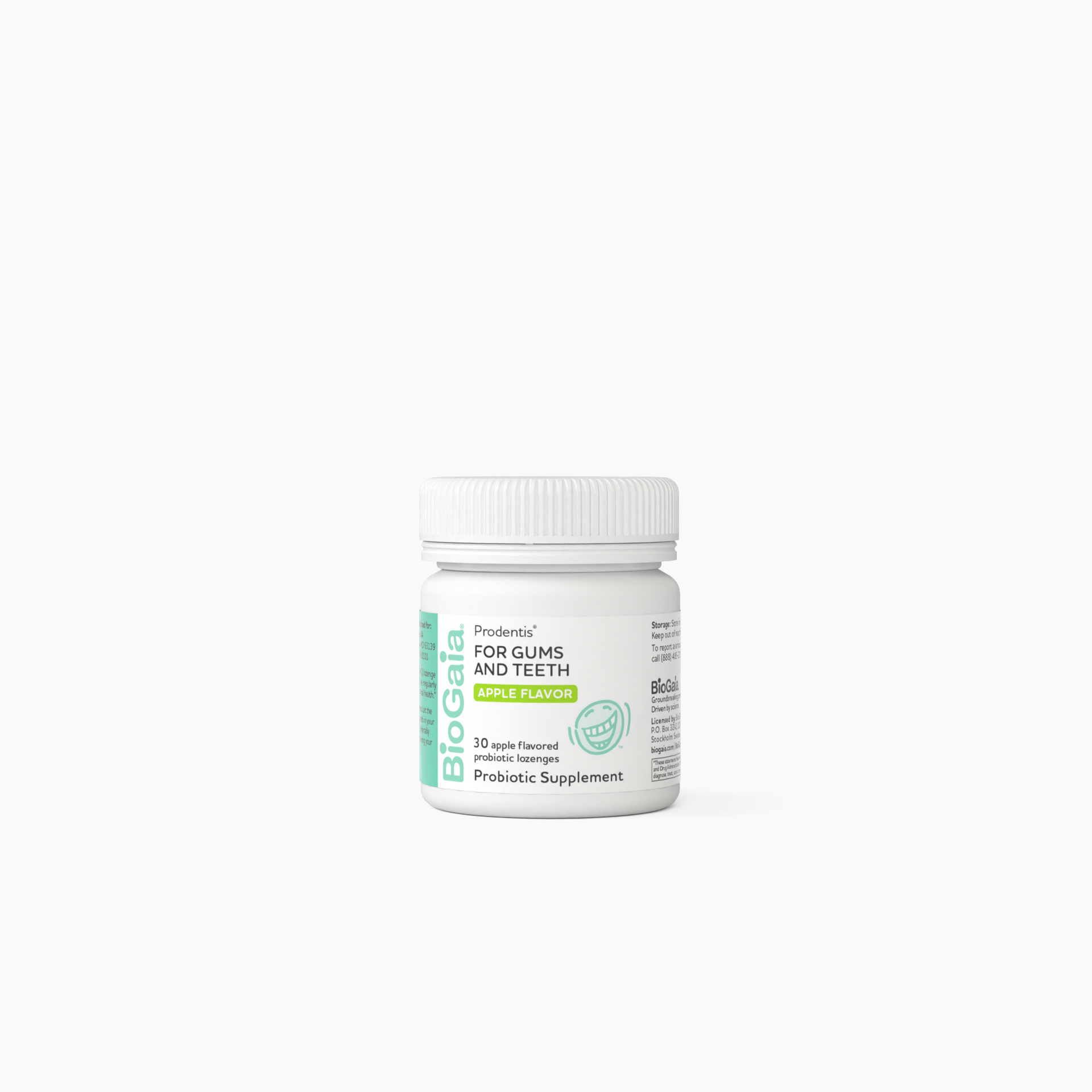

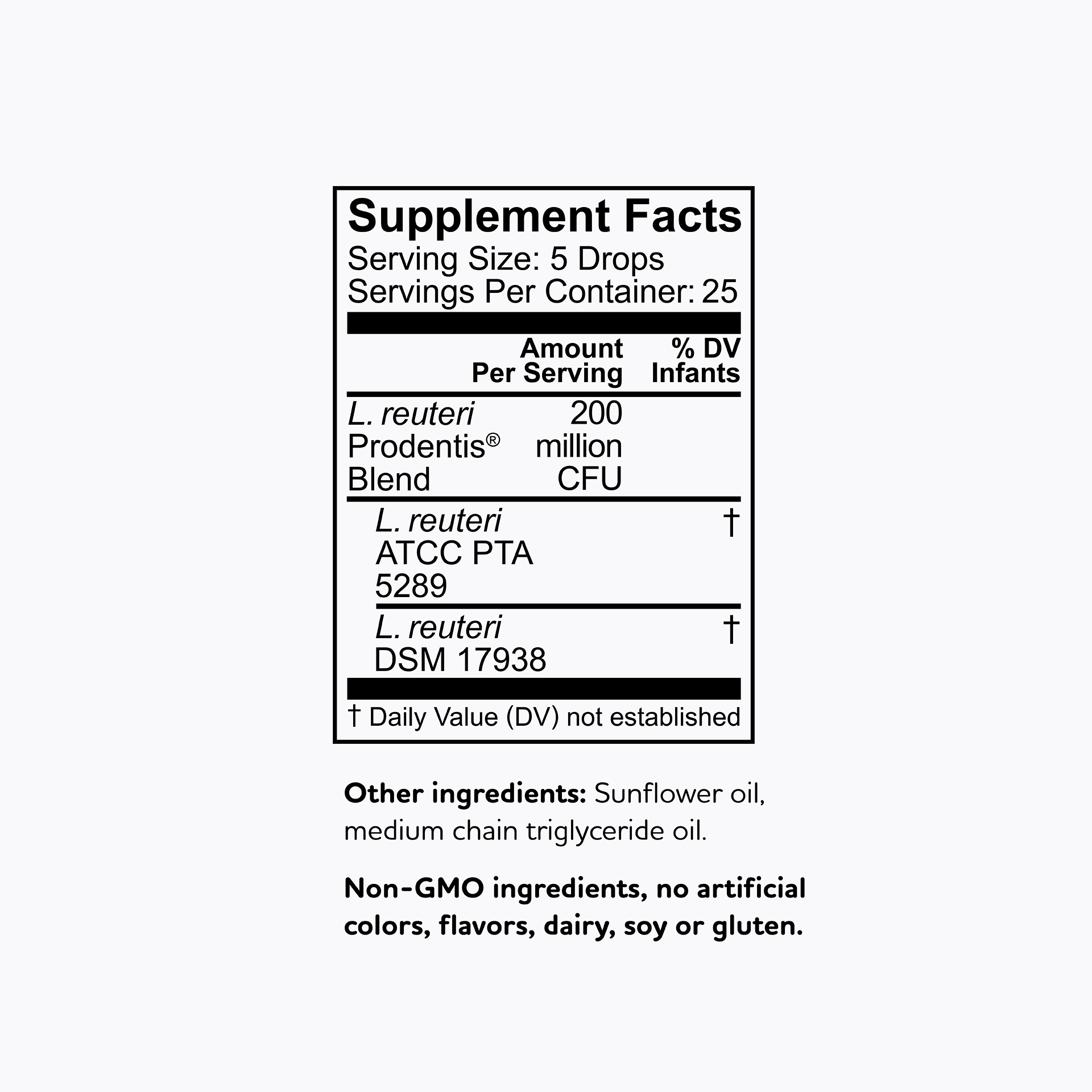

Probiotics and your oral health

What is the one thing that is understood by every language, every culture, and every civilization? A smile. Smiling is more than a way of...

The exciting and unexpected relationship between Antibiotics and Probiotics

In most things in life, anti is against, and pro is for. And in an age where we are given so many choices, making decisions...

Chanterelles: A prebiotic packed with vitamin D and fiber

The chanterelle is the mushroom celebrity of the fungi world. Crammed full of vitamins, minerals, and dietary fiber, it’s been known for its medicinal applications...

Why choose BioGaia's probiotics?